Why should we focus our development efforts on robotisation?

The sales of robots on global markets are growing year by year, and more and more companies see the benefits that can be brought by robotisation, especially when facing workforce shortages.

The sales of robots on global markets are growing year by year, and more and more companies see the benefits that can be brought by robotisation, especially when facing workforce shortages.

Transfer from the US to Japan

The history of using robots in industry goes back to the 1960s. Joseph Engelberger, an American scientist who earned the nickname of the “father of robotics”, was a prominent figure in this field. His “Unimate” company was the first one to manufacture industrial robots. However, Engelberger’s activities did not gain much popularity in the USA. The local trade unions were afraid that over time robots would replace people and take their jobs.

The situation in Japan was completely different. The country was in the midst of an economic boom. Industry was developing at a dizzying pace, new production facilities were being set up, and entrepreneurs had a huge problem with finding workers. Automation and robotisation of production was the answer to the needs of the rapidly growing Japanese market. As a result of the cooperation between the Japanese Kawasaki and the American Unimate, Kawasaki purchased a license for the hydraulically powered Kawasaki-Unimate 2000 robot. Already in the 1970s it was used for welding of car bodies by Nissan Motor Corporation and Toyota Motor Corporation. It was a very important step towards the development of industrial robotics.

Why robotisation?

The sales of robots on global markets are growing year by year, and more and more companies see the benefits that can be brought by robotisation. The reasons for the interest in robotising industry in Japan in the 1960s have not changed significantly over the years.

Falling unemployment and an ageing population make finding enough workers more and more difficult every year. According to specialists, these problems will only intensify in the coming years, so it is worth taking an interest in the solution offered by robotisation of production.

Similar challenges also emerge in Poland. Only a few years ago, employees considered automation and robotisation as a threat, while many employers viewed it as a development prospect. Today, it is the only viable course of action. Why? Despite the predictions of redundancies, the situation on the labour market is quite the opposite. According to the research conducted by ASTOR: „What technologies do manufacturing companies in Poland invest in?”, the number of partially automated companies is decreasing. More and more companies are investing in robotisation and what is more, they are combining different technologies.

Falling unemployment rate – opportunity or threat?

One of the biggest challenges for entrepreneurs is the shortage of workers. It is difficult to find both workers for simple jobs, which offer little opportunity for personal development, and highly qualified specialists. The reason behind this is the increasingly low level of unemployment.

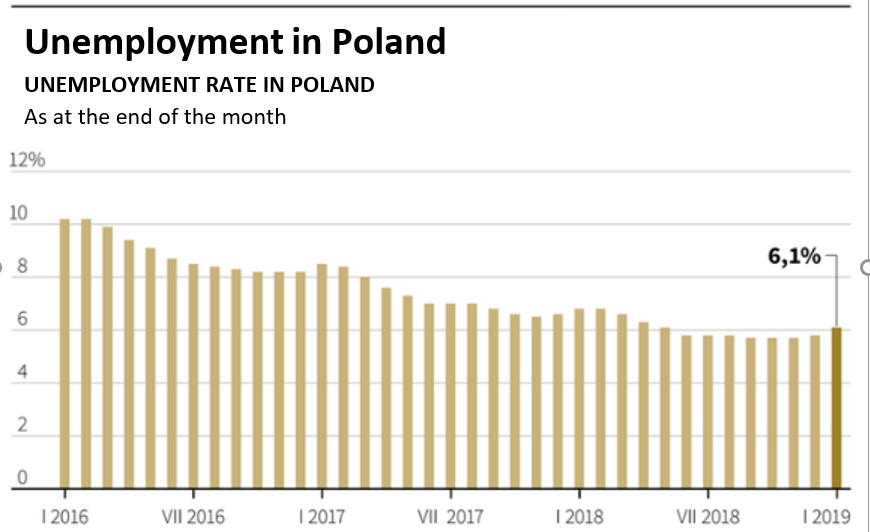

According to the data published by the Statistics Poland (GUS) at the end of January 2019, the unemployment rate in Poland was 6.1%. As can be seen in the chart below, though individual values vary slightly between voivodships, it is clear that fewer and fewer people have difficulty in finding jobs in the recent years.

source: Statistics Poland

The level of unemployment is inextricably linked to demographic factors.

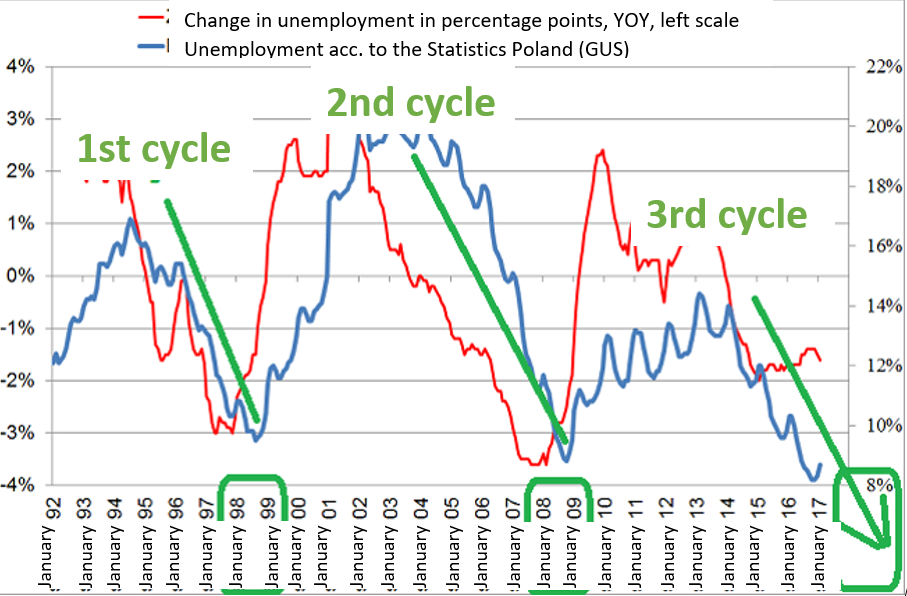

Over the past decades, it has become clear that in the years when baby boomers enter the labour market, the unemployment rate is rising rapidly. After 1989, just over 2.5 million people were entering the labour market. In 2004, when Poland joined the EU, there were as many as 3.5 million unemployed and a 20% unemployment rate, resulting in mass emigration of young people. Due to the low fertility rate of the Poles, baby booms will not be as numerous as they used to be in the past.

Unemployment over the years,

source: www.michalstopka.pl

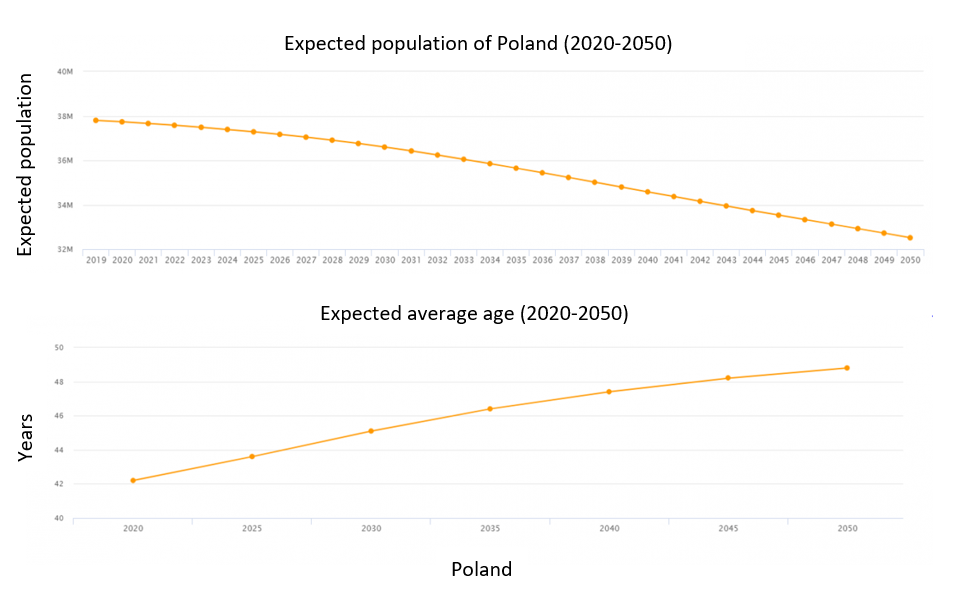

It should be noted that Poland is amongst the countries with the highest population decline. Experts estimate that in 2050 our population will shrink by as much as 15% (a decrease by 6 million). Consequently, the average age, which today is 42, will be 49 in about 30 years. These factors will lead to a continuous decline in the number of people of working age in the labour market.

It is estimated that already in 2025 this will be even 0.5 million less than today. Therefore, it can be concluded with a high probability that the difficulties in finding the right employees will be even greater in the future and will affect an increasing number of companies.

source: www.populationof.net

Low unemployment and state social programmes mean that fewer and fewer people are looking for employment in production, where work is often hard, monotonous and lacking in development prospects, and because of the repetitive and simple tasks performed, employers are not able to offer high remuneration for it.

Finding highly qualified employees is sometimes also problematic. Welders, for example, must not only have the right education but also manual skills and the right motivation to work in difficult, often dangerous and harmful conditions. Most of them have no problem with finding high-paid jobs in the West, which makes their financial expectations too high for Polish entrepreneurs.

Development of the global robotics market.

Another factor in favour of investment in robotics is the need to remain competitive in global markets. The Polish economy is largely export-oriented. Large, global corporations are willing to cooperate with Polish suppliers because our products are of high quality and relatively low price.

This is largely due to the fact that wages of Poles are still low when compared to other countries. However, salaries are rising year by year and, due to the low level of unemployment, financial expectations of employees are also on the rise. No all companies can afford to meet these expectations.

Because of large investments in automation and robotisation of production in the West, the competitiveness of Polish enterprises in the form of a relatively cheap labour force will decrease year by year. In a dozen or so years, the companies that do not decide to implement robots in their production may find it increasingly difficult to compete.

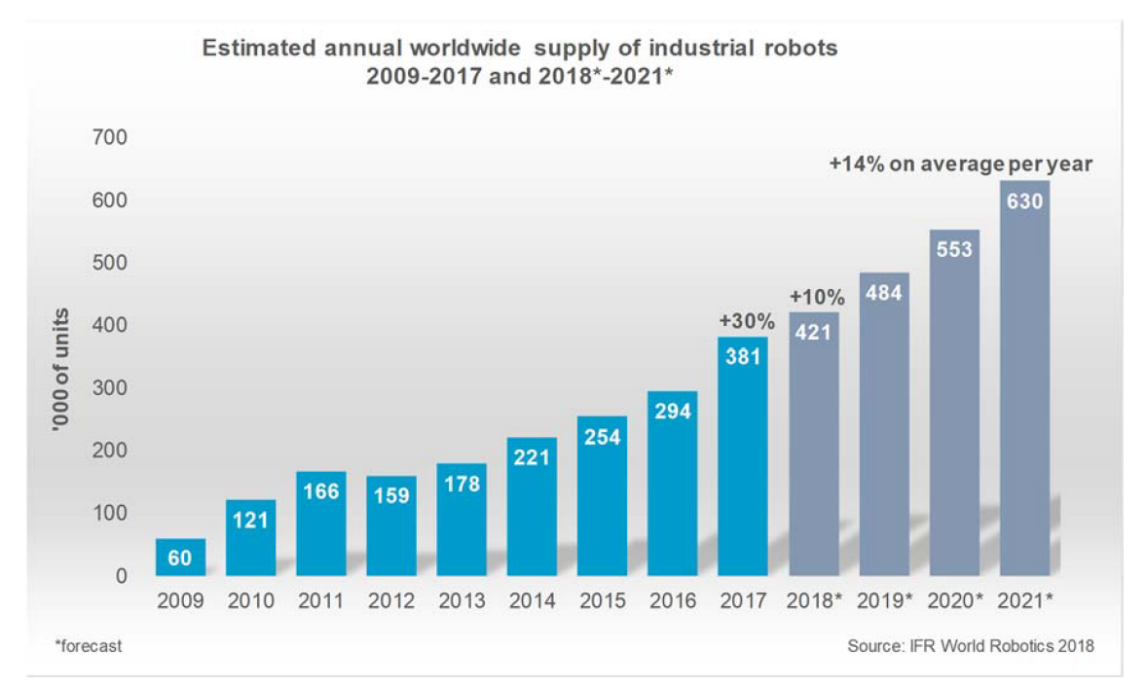

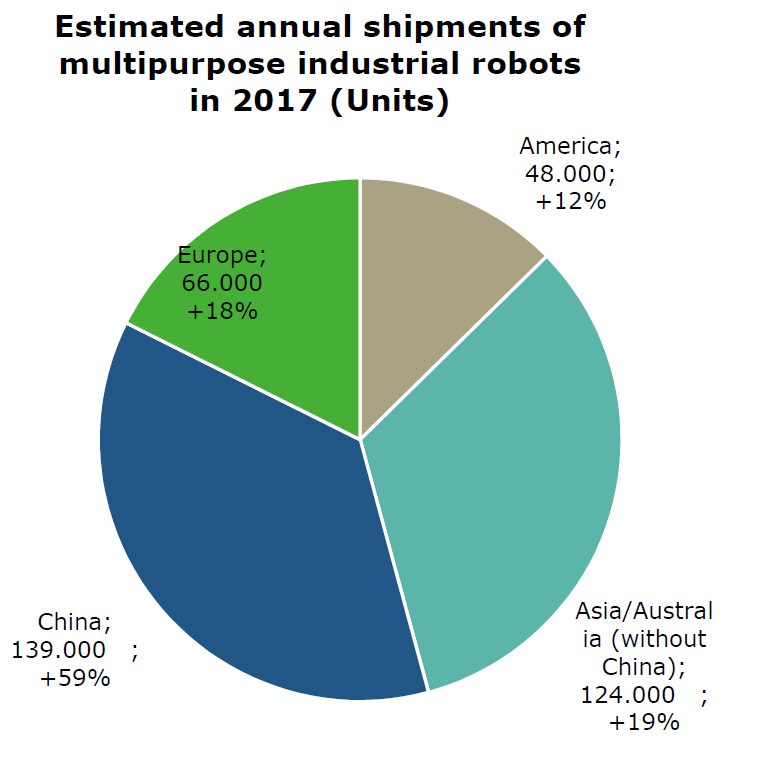

2017 was the fifth consecutive year with the highest annual robot sales, reaching 381,000 robots worldwide. If you look at the figures for 2007, when world sales reached 60,000, you can see the rate at which interest in robotics is growing. Experts estimate that if this rate of growth continues, the number of robots sold worldwide will reach 630,000 in 2021.

Source: IFR World Robotics 2018

Nearly 70% of all robots in the world are sold in Asian countries.

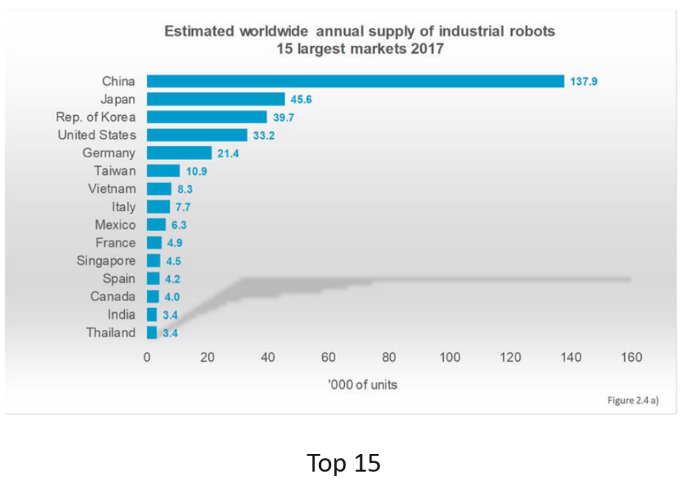

China has been the largest robotics market in the world for years, with 139,000 robots sold in 2017. It is worth noting that the sales have increased by 59% since 2007. This is largely due to the state’s „Made in China 2025” programme, with robotics as one of the key sectors. The aim of the programme is to comprehensively modernise China’s industry and economy.

The main objectives of the programme include improving the quality of Chinese products, as well as basing the industry on innovative, environmentally friendly methods. The state encourages its entrepreneurs to use industrial robots, leading to an increase in the number of robots from both domestic and foreign suppliers. It is estimated that more than one in three robots in the world has been installed in China. Japan came second in terms of robot sales, followed by Korea.

Source: IFR World Robotics 2018

Europe is the second continent in terms of the number of robots sold, with 17% of world sales. 66,000 of them were sold in 2017, a 19% increase compared to 2007. Germany holds the highest position among European countries, with 21,400 robots that gave it the fifth place. Poland ranked twenty-first on this list.

Source: IFR World Robotics 2018

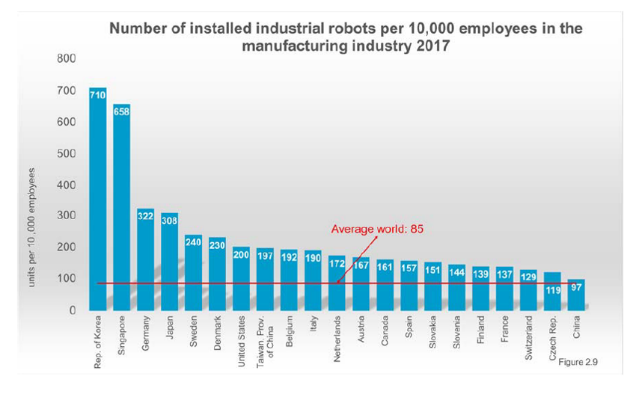

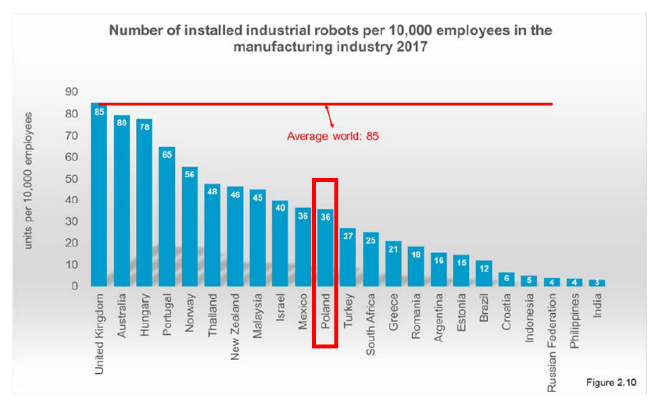

However, it is not only the number of robots sold that tells us about the level of robotisation in a given country. Another factor worth considering is the density of robotisation, i.e. the number of robots per 10,000 employees. According to data for 2017, there were 36 robots for every 10,000 employees in Poland. We’re behind here too. In highly developed countries, this rate is high, as few people choose a monotonous production work with little development prospects.

Source: IFR World Robotics 2018

As you can see, robotisation in Poland has grown significantly over the last 10 years. In 2017, 1,891 robots were sold here. This is a much better result than in 2007, when we had 505 robots sold, but we are far from the top.

Countries like Hungary and the Czech Republic are still ahead of us. In 2018, Polish GDP growth reached 5%, and it is estimated to grow by 3.5%-4% in 2019-2020. Higher GDP indicates an increasing consumption of goods. Therefore, it can be concluded that batch production will continue to be profitable in the coming years.

Advantages of robotisation

Advantages of robotisation

In order to survive in global markets and be competitive, it is important to continuously improve labour productivity. Production plants that take large orders from major global corporations cannot afford downtime, and thus delays in production and failure to meet deadlines. Lack of suitably qualified people, sick leave, staff turnover and induction of new employees are problems encountered by business owners on a daily basis. Another key challenge is maintaining a consistent and high quality of products without incurring unnecessary costs. Robotised production helps to save time, cut financial expenses, reduce the risk of error, and also allows to carry out tasks that could be dangerous for people.

Take the first step and find out more

The problems with finding qualified personnel caused by low unemployment and demographic factors, the need for competitiveness of Polish products on global markets, as well as the emergence of new production plants and modernisation of existing ones translate into growing investments of production companies in robotic solutions. Robot sales in global markets have increased significantly over the last decade, and according to forecasts, these values are expected to increase in the coming years. Investing in robotisation not only solves many problems faced by Polish industry, but is also synonymous with developing and strengthening the potential of factories and production facilities.

Contact

Wojciech Trojniar

Kawasaki Robotics CEE HUB Product / Marketing Manager

phone: +48 12 306 73 42

mail: w.trojniar@kawasakirobotics.pl